27+ paying extra on a mortgage

You can become debt-free faster if you make extra mortgage payments. At 45 on the mortgage you would expect in the long-term to have.

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Web Heres how the math works.

. Web Divide your monthly principal payment by 12. If you can up your payments by. By simply adding an extra 516 to your principal payment.

Web There are a few different ways you can make extra mortgage payments in a year. Compare Lenders And Find Out Which One Suits You Best. Web Preferred method for laying down mortgage for single people.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Comparisons Trusted by 55000000.

Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value. With todays interest rate of 701 a 30-year fixed mortgage of 100000 costs approximately. Web For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off the loan four payments earlier saving 2796 in interest.

If you buy that house at 4 interest after a 10 down payment you have monthly payments of 860. Web Additional Payment Calculator. Best Mortgage Lenders in New Mexico.

The average 30-year fixed mortgage is. Web There are a few ways you can pay extra on your mortgage. Web More pessimistic homebuyers want to ensure they can hang onto the lowest rate possible in case the market heads higher.

Making one extra payment each year. Looking For a House Loan. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web Case in point. Ad Calculate Your Payment with 0 Down. Web Paying extra is the cheap easy way to pay off your mortgage early If you have a mortgage chances are its a 30-year loan.

Web For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off. Its not a loan its a home equity agreement. Web Paying extra on your mortgage can save you money on interest.

Web If you decide to make extra payments on your mortgage make sure you earmark them with your lender so theyll go toward your loan principal. Paying extra on a mortgage may help reduce the amount of interest paid over time in addition to the total amount of time. Web Just paying an extra 50 per month will shave 2 years and 7 months off the loan and will save you over 12000 in the long run.

Its not a loan its a home equity agreement. If you can make 13 payments. And thats a long time to pay interest.

Ad 5 Best House Loan Lenders Compared Reviewed. By adding a little more to each. Web Effects of rounding up payment by 516 on a 200000 30-year fixed rate loan with 400 interest rate.

Web 20 hours agoThe APR was 690 last week. The average credit card interest rate is between 146 and 179 percent according to WalletHubs most recent Credit Card Landscape Report whereas. Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

No matter which method you choose its important to tell your loan provider that. Web Adding an Extra Mortgage Payment of 10 Per Month Even adding a nominal amount such as 5 or 10 On a monthly basis over a long period of time Can. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web That appears to be a reasonably correct conclusion between those two choices - but only those two choices. Im curious for those who are single and only have one income what is your preference to paying down. Web Potential benefits of paying extra on a mortgage.

APR is the all-in cost of your loan.

903 Beechcroft Road Spring Hill Tn 37174 Compass

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

5251 Mahan Corner Rd Marydel De 19964 Zillow

Should You Make Extra Mortgage Payments Compare Pros Cons

:max_bytes(150000):strip_icc()/GettyImages-1150533032-d457e0a44ec44974b4c547dba50e9a3a.jpg)

How Much Could You Save Making Extra Mortgage Payments

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

02048 Real Estate Homes For Sale Homes Com

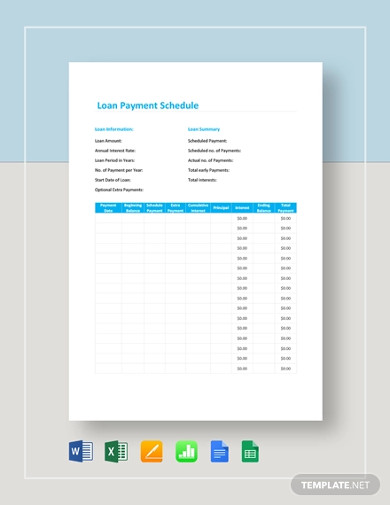

Loan Payment Schedule 10 Examples Format Pdf Examples

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

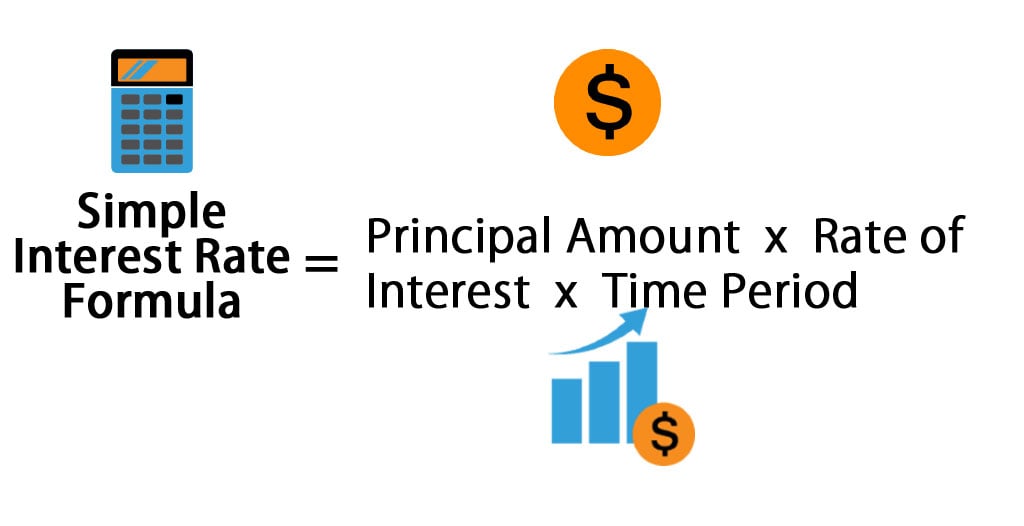

Simple Interest Rate Formula Calculator Excel Template

10 Strategies For Paying Off Your Mortgage Early

Bridge Loan What Are The Key Characteristics Of A Typical Bridge Loan

Early Mortgage Payoff Savings Pay Off Your Home Loan Early

19127 Pioneer Blvd 27 Artesia Ca 90701 Mls Dw22121150 Redfin

Mortgage Payoff Calculator Ramsey

Loan Schedule 15 Examples Format Pdf Examples

Are Extra Mortgage Payments Smart When Interest Rates Are Low Retire Before Dad